nj tax sale certificate foreclosure

Once a property owner fails to make property tax payments as required by New Jersey law the property may eventually subject to a New Jersey Tax Foreclosure. Tax sale certificates can earn interest of up to 18 per cent depending on the winning percentage bid at the.

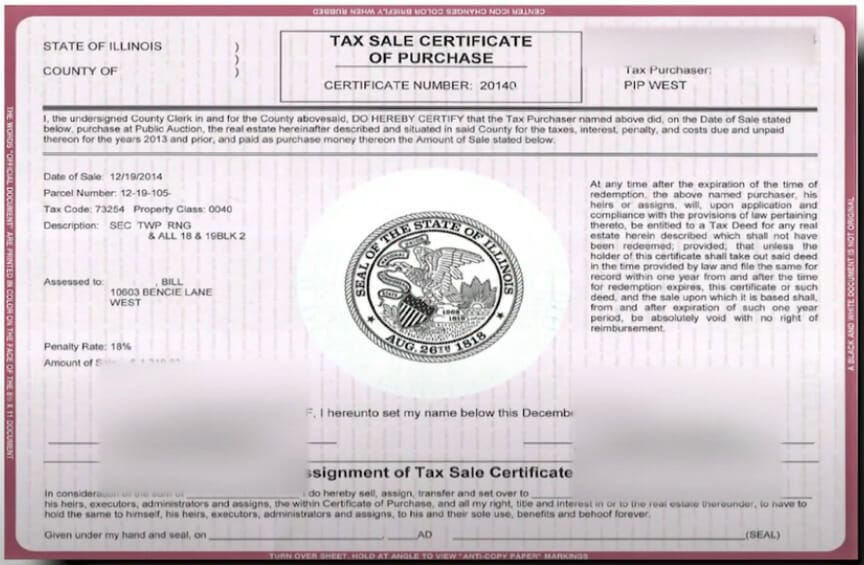

What Are Tax Lien Certificates How Do They Work Clean Slate Tax

By selling off these tax liens municipalities generate revenue.

. At the conclusion of a property tax certificate foreclosure action an order will state a date of redemption to redeem the tax. Normally it takes at least two years for a tax lien to be redeemed but with vacant properties they can have tax sale certificates foreclosed in as little as 6 months under the New Jersey Tax Sale law and if a municipality owns the lien it can also be foreclosed on in 6 months. What is sold is a tax sale certificate a lien on the property.

Understanding New Jersey Tax Sale Foreclosures. At the conclusion of the sale the. The sequence of procedural events was somewhat out of order.

If the purchaser is a municipality it must wait until six months after the tax sale to commence the action. There will normally not be a New Jersey sheriff auction after the foreclosure unless the Federal government also holds a lien on the property. If the purchaser is a.

A Tax Sale Certificate foreclosure is different than a bank loan Foreclosure. They are listed as being in the County where the property is located. Tax sales are conducted by the tax collector.

Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. The New Jersey Supreme Court in In re. If the purchaser is a private person heshe must wait until two 2 years after the tax sale to take action.

Elements of Tax Sales in New Jersey. Thirty-three days later file your complaint. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

Instead the Judge on the Tax Lien Foreclosure will sign over your house to the person who owns bought the Tax Lien Sale Certificate. Plymouth Park Tax Services LLC determined that under the Tax Sale Law NJSA. Every New Jersey municipality is authorized by statute to conduct public.

The idea for this post came from a recent client inquiry that we received about filing a tax foreclosure suit on behalf of an individual who has held a tax sale certificate for approximately 27 years against the home of her deceased parents and paid the real estate taxes during all 27 years. New Jersey law has long. Pre-foreclosure notice to owners mortgagees holders of older tax liens.

The Plaintiff in a tax sale foreclosure must at least 30 days prior to filing its complaint give written notice of its intention to foreclose as well as the amount necessary to redeem. This was an action to foreclose a tax sale certificate. Plaintiff also filed a motion to set the.

This notice must include the amount which the delinquent property owner can pay to redeem the tax sale certificate and have the lien released. The bottom line was that the Chancery Division granted a motion for intervention by a party who had already tendered the full redemption amount to the tax collector and denied plaintiffs motion to bar redemption. Non-municipal tax sale certificate holders must provide thirty days written notice of their intention to foreclose before they can begin the foreclosure process on the certificate.

No a tax sale certificate WILL NEVER be joined in a foreclosure action as it is considered a Super Priority Lien and thus cannot be divested Question. Third parties and the municipality bid on the tax sale certificates TSC. Normally it takes at least two years for a tax lien to be redeemed but with vacant properties they can have tax sale certificates foreclosed in as little as 6 months under the New Jersey Tax Sale law and if a municipality owns the lien it can also be foreclosed on in 6 months.

The final judgment was recorded 6 months ago why am I being told that you will not insure everything looks up to par. If the tax lien certificate is redeemed by the delinquent property owner prior to foreclosure the tax lien certificate earns a redemption penalty at the rate of 2 4 or 6 percent depending on the amount of the original tax lien certificate in addition to any interest rate on the certificate. At the tax sale title to the delinquent property itself is not sold.

All municipalities in New Jersey are required by statute to hold annual sales of unpaid real estate taxes. New jersey tax sale certificate foreclosure taxes less time than a new jersey bank foreclosure unlike a foreclosure sale held by a county sheriff when the property is sold and the sheriff issues a deed these nj tax certificate auctions are based on people bidding on the interest rate to be charged on the tax lien that will be placed on a home. Most property owners know about their obligation to pay annual property taxes to the municipality in which the property is located.

If the certificate is redeemed by the property owner prior. This post discusses only those tax sale foreclosures completed by individual non-municipal TSC holders. However in New Jersey like most states a different lesser known form of property foreclosure routinely takes place pursuant to New Jerseys Tax Sale Certificate Law.

In New Jersey a tax foreclosure is a strict foreclosure meaning that judgment vests title directly to the holder of the tax lien. 545-1 to -137 a purchaser of a tax sale certificate acquires a tax lien not a lien securing the property owners obligation to pay the amount owing to redeem the certificate. New Jersey Tax Sale Certificate Foreclosure is a Tax Lien Foreclosure A property owner faces losing his or her property once he or she stops making tax payments or paying sewer and water bills.

One is by authorizing municipalities to hold special tax sales of abandoned properties as spelled out in NJSA5519-101. Public policy disfavors tax sale foreclosure. FORECLOSURE OF MORTGAGES CONDOMINIUM ASSOCIATION LIENS AND TAX SALE CERTIFICATES.

According to New Jersey Law on tax lien certificate greater than 200 a penalty of 2 is. The other is by allowing buyers of tax sale certificates to initiate foreclosure on abandoned properties immediately rather than waiting the two-year period otherwise required as well as giving them other rights. RULES GOVERNING THE COURTS OF THE STATE OF NEW JERSEY RULE 464.

In NJ all foreclosures are filed centrally in the Foreclosure Section of the Superior Court. Princeton Office Park LP. The Foreclosure Process in a nutshell.

Foreclosure Complaint Uncontested Judgment Other Than In Rem Tax Foreclosures a Title Search. The purchaser of a Tax Sale Certificate may foreclose any rights of redemption by commencing a strict foreclosure action.

What Are Tax Lien Certificates How Do They Work Clean Slate Tax

What Is A Co Op Apartment Hauseit Apartment Co Op Apartment Building

Make Money With Tax Liens Know The Rules Ted Thomas

Nj Tax Lien Foreclosure Attorneys

1838 Abandoned House In Salem Alabama Captivating Houses Old Houses For Sale Abandoned Houses Old House Dreams

Will You Get A Break On Your N J Property Taxes During Coronavirus Crisis Nj Com

New Jersey Tax Sale Certificate Foreclosure Pscb Law New York And New Jersey Lawyers New Jersey Foreclosure Defense

Understanding Nj Tax Lien Foreclosure Westmarq

What Is A Tax Lien Certificate United Tax Liens

Full Images Canada House Zillow Homes For Sale Renting A House